Form of insurance that protects a business from employee theft. – Employee theft insurance stands as a crucial form of protection for businesses, shielding them from the financial and reputational risks associated with employee theft. This comprehensive coverage ensures that businesses can operate with confidence, knowing that they are protected against the unfortunate but prevalent issue of employee misconduct.

The prevalence of employee theft underscores the significance of this insurance. According to the Association of Certified Fraud Examiners (ACFE), employee fraud costs businesses an estimated 5% of their annual revenue. This staggering figure highlights the need for businesses to prioritize employee theft prevention and protection measures, with insurance serving as a vital component of this strategy.

Overview of Employee Theft Insurance

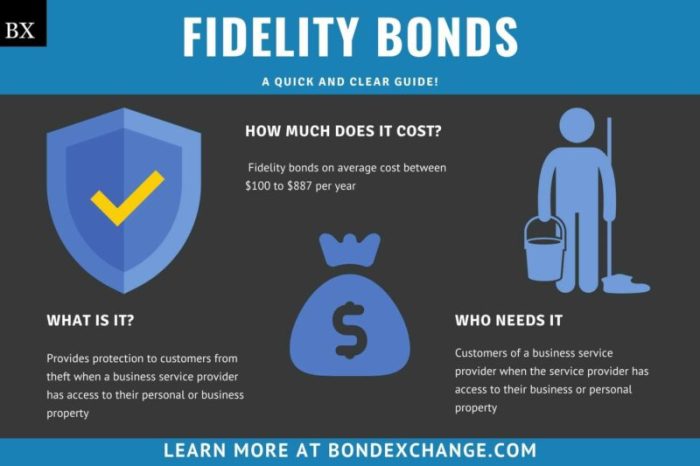

Employee theft insurance is a type of insurance that protects businesses from financial losses resulting from the theft of money, property, or other assets by their employees. It provides coverage for various forms of employee theft, including embezzlement, larceny, and fraud.

Businesses that typically need employee theft insurance include:

- Retail stores

- Financial institutions

- Restaurants

- Healthcare providers

- Manufacturing companies

Common employee theft scenarios covered by insurance include:

- Cashier stealing cash from a register

- Employee embezzling funds from a company bank account

- Manager stealing inventory for personal use

- Employee using company credit cards for unauthorized purchases

Key Features of Employee Theft Insurance Policies

Most employee theft insurance policies include the following standard coverages:

- Coverage for theft of money, property, and other assets

- Coverage for employee dishonesty and fraud

- Coverage for expenses incurred in investigating and prosecuting employee theft

It is important to understand policy limits and deductibles when purchasing employee theft insurance. Policy limits represent the maximum amount the insurer will pay for a covered loss, while deductibles are the amount the business must pay out of pocket before the insurance coverage kicks in.

Employee theft insurance policies may also have exclusions or limitations that apply to coverage. These exclusions can vary depending on the policy, but common exclusions include:

- Losses caused by employees who are not covered under the policy

- Losses caused by acts of war or terrorism

- Losses caused by employee negligence

Methods for Preventing Employee Theft

Businesses can implement several best practices to prevent employee theft, including:

- Conducting thorough background checks on potential employees

- Implementing internal controls, such as segregation of duties and regular audits

- Providing employee training and awareness programs on the importance of preventing theft

Employee training and awareness programs should focus on educating employees about the consequences of theft, the company’s policies and procedures for preventing theft, and the importance of reporting any suspicious activity.

By implementing these strategies, businesses can significantly reduce their risk of employee theft.

Claims Process for Employee Theft Insurance

To file a claim for employee theft insurance, businesses should follow these steps:

- Report the theft to the police and obtain a police report

- Notify the insurance company and provide a detailed account of the theft

- Submit documentation and evidence to support the claim, such as the police report, inventory records, and financial statements

The insurance company will investigate the claim and determine the amount of coverage available. The claim processing and settlement timeframe can vary depending on the complexity of the claim.

Choosing the Right Employee Theft Insurance Provider: Form Of Insurance That Protects A Business From Employee Theft.

When choosing an employee theft insurance provider, businesses should consider the following factors:

- Financial stability of the insurer

- Claims handling reputation of the insurer

- Customer service of the insurer

Businesses should also compare quotes from multiple insurers to find the best coverage and price.

Frequently Asked Questions

What are the common types of employee theft covered by insurance?

Employee theft insurance typically covers various forms of theft, including cash theft, inventory theft, equipment theft, and fraudulent expense claims.

What are the key factors to consider when selecting an employee theft insurance provider?

When choosing an employee theft insurance provider, businesses should evaluate factors such as financial stability, claims handling efficiency, customer service, and the reputation of the insurer.

What steps should businesses take to prevent employee theft?

Effective employee theft prevention strategies include conducting thorough background checks, implementing robust internal controls, providing employee training and awareness programs, and fostering a culture of integrity and accountability.